- Top AI Investors: Venture Capital Firms Leading the AI Boom

- Introduction

- Why AI Investment Is Booming in 2025

- What Makes a Top AI Investor?

- Top Global Venture Capital Firms Investing in AI

- Notable AI Investments and Startup Success Stories

- Leading AI Investors in North America

- Top AI Investment Firms in Europe

- Emerging AI Investors in Asia and the Middle East

- Angel Investors and Tech Titans Backing AI

- AI Investment Trends to Watch in 2025

- Risks and Challenges in AI Investing

- Conclusion

- FAQS

- Introduction

Top AI Investors: Venture Capital Firms Leading the AI Boom

Introduction

Artificial Intelligence (AI) continues to reshape industries, redefine business models, and drive technological progress at an unprecedented pace. As we enter 2025, the global AI investment landscape has become more dynamic than ever, with venture capital firms playing a crucial role in accelerating innovation. These investors are not just funding startups—they are strategically backing the technologies that will power the future, from generative AI and machine learning platforms to robotics, healthcare ai investors, and autonomous systems.

Venture capitalists are pouring billions into ai investors startups, betting on the next wave of disruptive solutions. Their investments are shaping not only the success of individual companies but also the broader direction of AI adoption worldwide. This article explores the top AI investors of 2025—those who are leading the charge, making bold bets, and positioning themselves at the forefront of the AI revolution. Whether you’re a founder, researcher, or enthusiast, understanding these key players is essential.

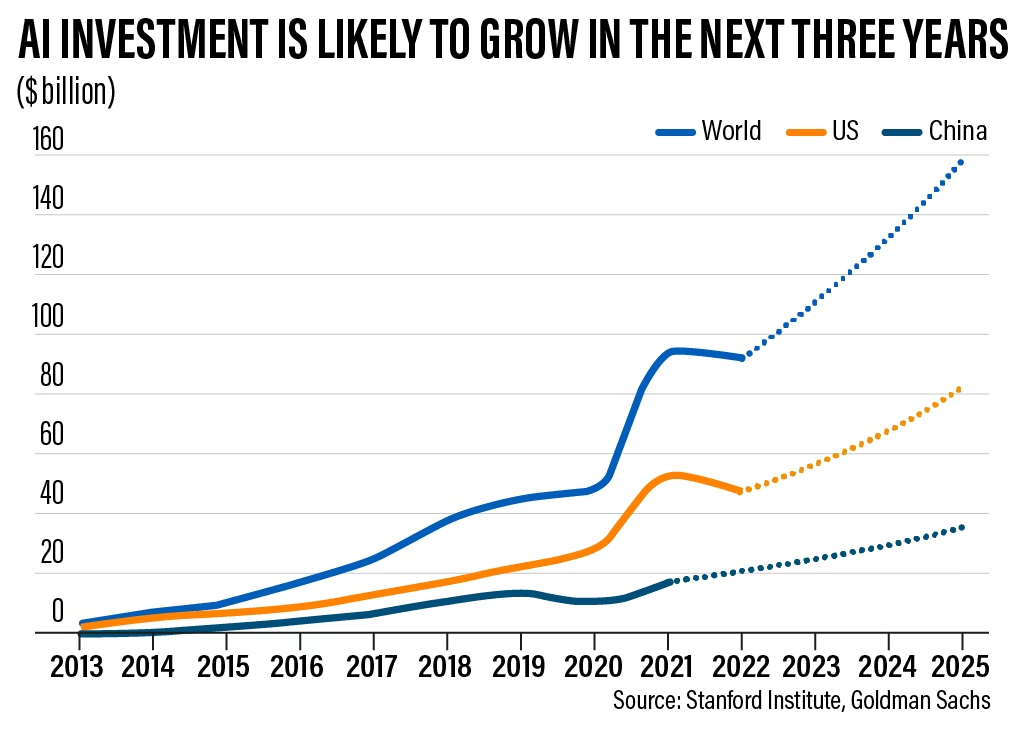

Why AI Investment Is Booming in 2025

The AI sector in 2025 is experiencing explosive growth, driven by rapid advancements in generative models, automation, and AI-driven enterprise solutions. Businesses across industries—from healthcare to finance—are integrating ai investors to improve efficiency and decision-making. Governments and corporations alike are allocating more funding toward AI research and development. This surge in demand has made AI one of the most attractive spaces for investors, creating fierce competition among venture capital firms to back the most promising technologies and startups before they become the next unicorns.

What Makes a Top AI Investor?

Top AI investors stand out not just because of the size of their investments, but due to their ability to identify emerging technologies early, support technical founders, and scale ai investors startups to global success. These firms often have dedicated AI-focused funds, deep technical advisory teams, and strategic partnerships across industries. What truly sets them apart is their long-term vision, domain expertise, and hands-on approach—qualities that enable them to guide startups through complex technological, ethical, and regulatory challenges in the ai investors space.

Top Global Venture Capital Firms Investing in AI

In 2025, several global VC firms have emerged as dominant players in the ai investors space, consistently funding category-defining startups. Firms like Andreessen Horowitz, Sequoia Capital, SoftBank, and Accel are leading large funding rounds in ai investors startups spanning language models, robotics, biotech, and more. These investors bring a combination of capital, network, and experience that helps founders innovate at scale. Their global reach also allows them to tap into emerging markets and technologies, making them influential forces in shaping the direction and speed of AI development worldwide.

Notable AI Investments and Startup Success Stories

Several standout AI startups have captured global attention in 2025 thanks to strategic backing from top venture capital firms. Companies like OpenAI, Anthropic, and Mistral ai investors have raised multi-million-dollar rounds, pushing boundaries in generative AI and machine learning. Startups in sectors like healthcare diagnostics, autonomous vehicles, and AI cybersecurity have also attracted significant funding. These success stories highlight the importance of investor vision and early-stage support in transforming experimental AI concepts into scalable, real-world solutions with wide-ranging impact.

Leading AI Investors in North America

North America remains a global leader in AI innovation, largely fueled by top venture capital firms based in the United States and Canada. Prominent names like Andreessen Horowitz, Greylock Partners, and Lightspeed Venture Partners are driving substantial investments in ai investors startups across Silicon Valley, Boston, and Toronto. These firms often lead Series A and B rounds, providing not just capital but also mentorship and access to key networks. Their deep connections to tech hubs and universities give them a distinct edge in sourcing and supporting high-potential AI founders.

Top AI Investment Firms in Europe

Europe’s AI ecosystem has matured rapidly, with cities like London, Berlin, and Paris emerging as innovation hubs. Leading European venture capital firms such as Atomico, Balderton Capital, and Earlybird Venture Capital are playing a major role in supporting AI startups across sectors like fintech, climate tech, and health tech. These firms are increasingly collaborating with public institutions and research labs to nurture cutting-edge developments. With a focus on ethical ai investors and long-term sustainability, European investors are helping shape a uniquely responsible and innovative AI landscape.

Emerging AI Investors in Asia and the Middle East

Asia and the Middle East have become rapidly growing hotspots for AI investment in 2025. Countries like China, India, the UAE, and Saudi Arabia are investing heavily in AI infrastructure and startups. Prominent firms such as GGV Capital, Sequoia India, and Mubadala Ventures are actively funding companies across sectors like fintech, smart cities, and healthcare AI. These regions are not only attracting local capital but also global interest due to government-backed AI initiatives, talent pools, and their strategic push to become global AI powerhouses.

Angel Investors and Tech Titans Backing AI

Beyond institutional investors, influential tech founders and angel investors are also playing a critical role in advancing ai investors innovation. Individuals like Elon Musk, Reid Hoffman, and Naval Ravikant are making direct investments in promising ai investors startups. Many of these tech titans bring deep industry experience, mentorship, and access to powerful networks. Their involvement often provides credibility and early momentum for emerging companies. In 2025, such angel investors are particularly focused on frontier AI technologies, including artificial general intelligence (AGI), AI safety, and autonomous systems.

AI Investment Trends to Watch in 2025

As the AI landscape evolves, several investment trends are gaining momentum in 2025. There’s growing interest in vertical AI solutions tailored for industries like legal tech, agriculture, and logistics. Infrastructure ai investors—tools for training, deploying, and scaling models—is also attracting significant funding. Another major trend is the integration of AI with quantum computing and edge devices. Investors are increasingly prioritizing responsible and explainable AI, with an eye on ethical considerations and regulatory compliance. These trends are helping shape the next generation of AI startups and technologies.

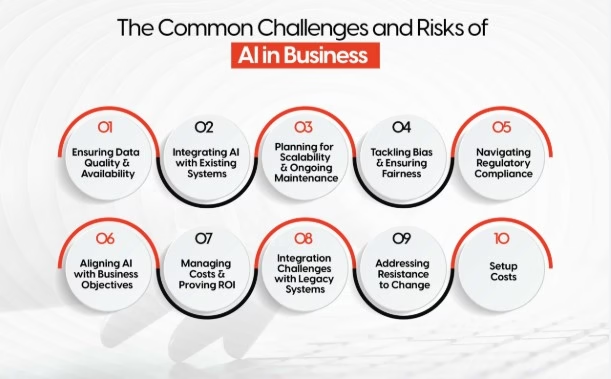

Risks and Challenges in AI Investing

While AI offers immense potential, investing in this sector comes with notable risks. Overhyped valuations, technical uncertainty, and intense competition can make it difficult to predict long-term winners. Regulatory concerns around data privacy, algorithmic bias, and job displacement are also growing. Additionally, the rapid pace of innovation means today’s breakthrough can quickly become obsolete. Venture capital firms must navigate these challenges carefully, balancing bold bets with due diligence. Successful ai investors in 2025 are those who understand both the technology’s promise and its pitfalls.

Conclusion

The AI investment landscape in 2025 is more active, competitive, and transformative than ever before. Venture capital firms and individual investors are not only funding the next wave of innovation but actively shaping how ai investors will impact society. From global powerhouses to emerging regional players, these investors are fueling groundbreaking advancements across industries. As AI continues to evolve, understanding who is backing it—and why—is key to anticipating where the technology is headed next. The future of AI is being written today, one investment at a time.

You Can Also Read: Trading 212 Uninvested Cash Interest: Rates, Terms, and Benefits

FAQS

Who are the biggest investors in AI?

Top Venture Capital Firms Investing in AI

In 2024, firms like Sequoia Capital, Andreessen Horowitz (a16z), Index Ventures, Coatue, and Greylock aggressively scaled their AI portfolios.

Who is the No 1 AI in the world?

As a leader in the AI space, Google Assistant is considered to be one of the most advanced virtual assistants of its kind on the market. Using natural language processing, it supports both voice and text commands, and can handle everything from internet searches to voice-activated control of other devices.

Who owns ChatGPT?

ChatGPT is owned by OpenAI, an AI research and deployment company. OpenAI began as a non-profit but transitioned to a for-profit structure in 2019, although it still has a strong nonprofit mission. Microsoft is a major investor in OpenAI.

Is AI good for investing?

AI is making its mark as a powerful tool in modern investing, offering capabilities that can enhance investment decision-making and portfolio management.

Can I invest in OpenAI?

You can’t buy OpenAI stock on a normal exchange — but you can invest in one of its partners, and some investors may be eligible to buy shares on private equity markets.

[…] the advantages and disadvantages of venture capital is essential before deciding if it’s the right path for your business. This guide will walk […]

I want to thank you for your assistance and this post. It’s been great. http://www.kayswell.com

I know this if off topic but I’m looking into starting my own blog and was curious what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100 positive. Any recommendations or advice would be greatly appreciated. Thanks

I’d like to thank you for the efforts you have put in writing this blog.I’m hoping to check out the same high-grade content from you later on as well. In truth, http://www.kayswell.com your creative writing abilities has motivated me to get my very own website now 😉