Trading 212 Uninvested Cash Interest: Rates, Terms, and Benefits

Introduction

When using Trading 212, many investors may wonder what happens to their uninvested cash—the money sitting idle in their accounts without being allocated to stocks or other assets. Unlike some brokers that do not offer any benefits on uninvested cash, Trading 212 provides an opportunity for clients to earn interest on these funds. Understanding how Trading 212 handles uninvested cash interest, including current rates, terms, and benefits, is important for maximizing returns on your portfolio.

This guide explores everything you need to know about Trading 212’s uninvested cash interest, helping you make informed decisions about managing your funds effectively and ensuring your money works for you, even when it’s not actively invested.

What Is Uninvested Cash in Trading 212?

Uninvested cash refers to the portion of your Trading 212 account balance that is not currently used to buy stocks, ETFs, or other securities. This cash remains in your account as available funds, either waiting to be invested or held for withdrawal. It’s important to note that uninvested cash does not generate returns unless the broker offers an interest rate on it. Trading 212 allows users to earn interest on this idle cash, meaning your money can grow even when you’re not actively trading. This feature benefits users by reducing opportunity costs on funds that would otherwise just sit unused.

How Does Trading 212 Handle Uninvested Cash?

Trading 212 keeps uninvested cash in segregated client accounts, ensuring safety and transparency. The broker applies a specific interest rate to the cash balance, which is credited periodically according to their terms. This interest acts as a small passive income stream for users, compensating for idle funds. However, the exact process and conditions for earning interest, such as minimum balance requirements or caps on interest, vary based on Trading 212’s policies. By handling uninvested cash in this way, Trading 212 helps users maximize returns without needing to constantly trade or invest every penny.

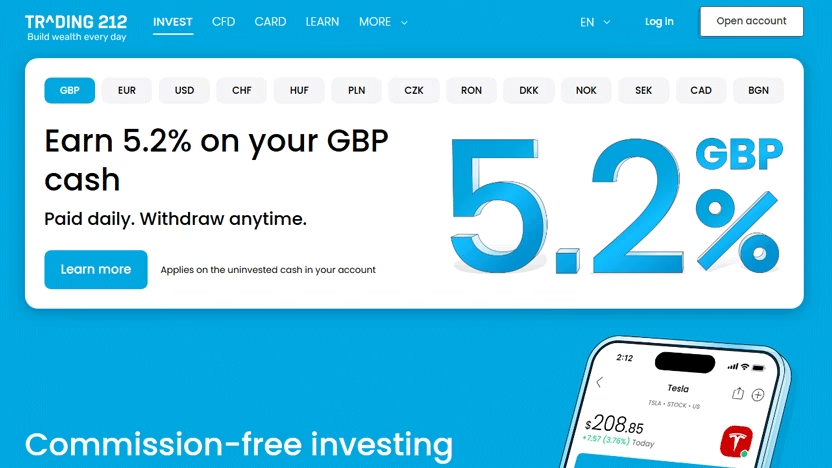

Current Interest Rates on Uninvested Cash in Trading 212

Trading 212 offers a competitive interest rate on uninvested cash, though the exact rate may vary depending on market conditions and regulatory factors. Typically, this rate is lower than rates offered on dedicated savings accounts but still provides a useful way to earn passive income on idle funds. It’s important to check Trading 212’s official website or app regularly for the most up-to-date interest rates, as these can change based on economic trends and company policies.

Eligibility Criteria for Earning Interest on Uninvested Cash

Not all Trading 212 users automatically earn interest on their uninvested cash. To qualify, there may be specific eligibility requirements such as a minimum account balance or maintaining certain account types. Additionally, some promotional or regional restrictions might apply, influencing who can benefit from the interest feature. Understanding these criteria helps investors know when they can expect to receive interest and avoid surprises in their account statements.

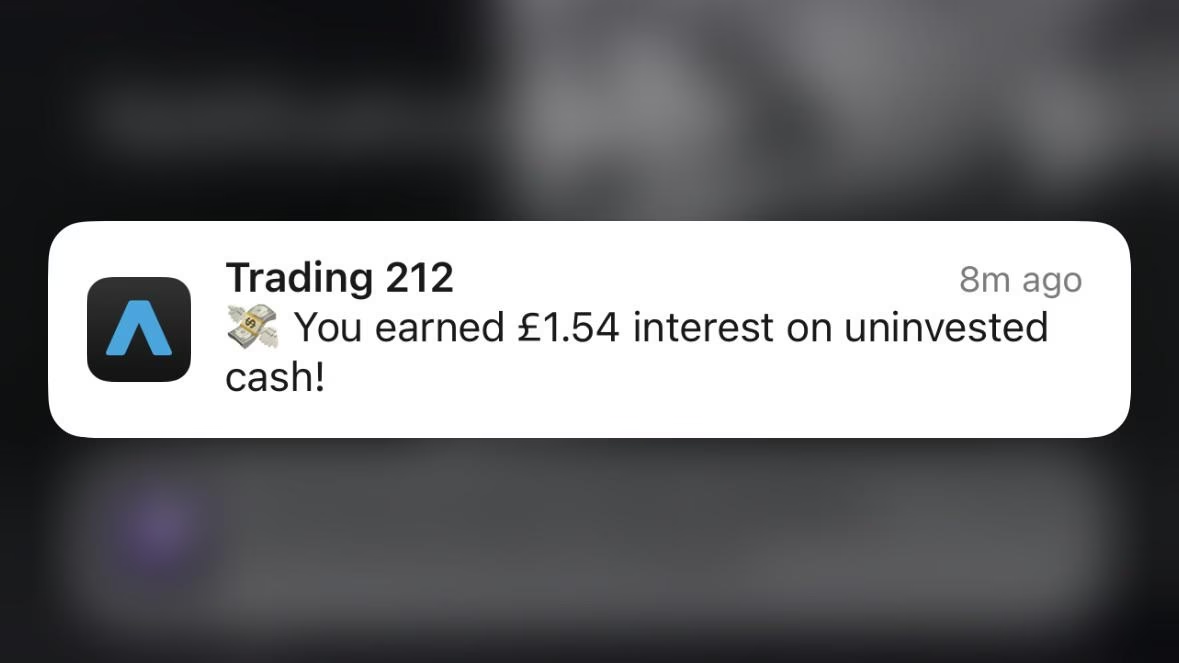

How Often Is Interest Paid on Uninvested Cash?

Trading 212 typically credits interest on uninvested cash on a monthly basis, though this schedule can vary. Regular payments help investors benefit from compounding returns over time. It’s advisable to review the broker’s terms and conditions to confirm the exact frequency and timing of interest payments. Staying informed about these details ensures you can track your passive income and make timely decisions about your cash management strategy.

Terms and Conditions for Trading 212 Uninvested Cash Interest

Trading 212’s interest on uninvested cash comes with specific terms and conditions that users must understand. These typically include minimum balance requirements, limits on the maximum interest payable, and rules about how long the cash must remain idle to qualify. Additionally, Trading 212 may reserve the right to change rates or terms with notice. Reviewing these details carefully helps investors avoid misunderstandings and ensures they fully benefit from the interest on their uninvested cash.

Comparison of Trading 212 Interest Rates with Other Brokers

When comparing Trading 212’s uninvested cash interest rate with other brokers, it’s clear that rates vary widely across platforms. Some brokers offer higher interest rates but may have stricter requirements or fees. Others may not pay any interest at all. Trading 212’s rate strikes a balance between accessibility and earning potential, making it competitive for casual and active investors alike. Comparing rates helps users decide if Trading 212 meets their needs or if another broker might offer better returns on idle cash.

Benefits of Earning Interest on Uninvested Cash

Earning interest on uninvested cash offers multiple benefits. It helps reduce the opportunity cost of holding idle funds, turning what would otherwise be stagnant money into a small but steady income source. This can improve overall portfolio returns, especially for users who keep cash on hand for future investments or withdrawals. Additionally, interest earnings increase liquidity without risking principal, providing a safe way to boost account value over time.

Risks and Limitations of Trading 212 Uninvested Cash Interest

While earning interest on uninvested cash is beneficial, there are some risks and limitations to consider. Interest rates can fluctuate and may be lower than inflation, reducing real returns. Additionally, there might be caps on the amount of cash eligible for interest, or minimum balance requirements that exclude smaller accounts. Trading 212’s policies can also change over time, impacting the interest paid. Investors should be aware that uninvested cash interest is not a substitute for active investing.

How to Maximize Returns on Your Uninvested Cash in Trading 212

To get the most out of Trading 212’s uninvested cash interest, maintain a sufficient cash balance to meet any minimum requirements. Regularly check interest rate updates and adjust your cash holdings accordingly. Additionally, consider timing your investments to optimize the cash balance for interest payments. Combining interest earnings with strategic investing can help improve your overall portfolio performance and make your idle funds work harder for you.

You Can Also Read: The Best Trading Platforms for Investors

Conclusion

Trading 212’s uninvested cash interest provides a valuable way to earn passive income on idle funds. While the rates may not rival high-yield savings accounts, they add a useful return with minimal effort. Understanding the terms, conditions, and how to optimize your cash balance is key to benefiting fully. For investors who frequently hold uninvested cash, Trading 212’s interest feature is definitely worth considering as part of an overall investment strategy.

FAQS

Does Trading 212 pay interest on uninvested cash?

Trading 212 pays interest on uninvested cash held in 13 currencies: EUR, USD, GBP, CAD, PLN, CZK, RON, BGN, HUF, CHF, DKK, NOK, SEK. Disclaimer: When investing, your capital is at risk. If you enable interest, Trading 212 will hold your cash in qualifying money market funds and banks.

How to avoid Trading 212 0.7% fee?

Deposits on Trading 212 are mostly free, but I have found that there is a 0.7% fee on deposits over £2,000 when using certain payment methods like debit/credit cards. To avoid this charge, I now use bank transfers whenever possible.

Is Trading 212 interest on cash safe?

Is my money still protected? Where we hold your money with a bank, clients of Trading 212 UK Ltd. are protected by the FSCS up to a limit of £85,000. Clients of Trading 212 Markets Ltd.

What can I do with uninvested cash in brokerage account?

As an alternative to bank sweep programs or money market fund sweep programs, uninvested cash in an investment account may simply remain on deposit at the investment firm. This is generally known as a “free credit balance.” Investment firms may or may not pay interest on your free credit balance.

What happens to my money if Trading 212 goes bust?

Funds protection

It is important to note that we do not utilize any of our clients’ funds for our own hedging or margin trading. By keeping client funds separate from our own, in the unlikely event that Trading 212 were to become insolvent, your funds would still be accessible to you.

nice art