The Best Trading Platforms for Investors

Introduction

The realm of online trading platforms is dynamic, offering a multitude of options for investors . This outline provides a framework for navigating this landscape, highlighting the crucial elements to consider when choosing a platform. It will delve into the key features that define top-tier platforms, explore the various categories available, and offer guidance on selecting the best platforms based on individual investor profiles. Furthermore, it will address the critical aspects of fee structures, security protocols, and available support systems.

Ultimately, this outline aims to equip investors with the knowledge necessary to make informed decisions and optimize their trading activities.

Key Platform Features

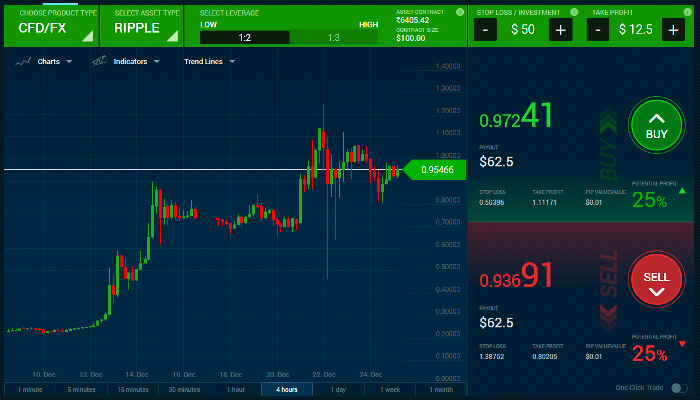

A strong trading platform equips users with a user-friendly interface, diverse order types, real-time data, and charting tools. These elements are crucial for both novice and experienced traders. The interface should be intuitive, allowing for easy navigation and trade execution. A wide range of order types, such as market, limit, and stop-loss orders, provides flexibility in managing risk and executing investment strategies. The Best Trading Platforms for Investors Real-time data and comprehensive charting tools enable investors to make informed decisions based on current market conditions and historical trends. Mobile trading, robust security measures, and reliable customer support are also essential components of a high-quality platform.

These features collectively empower investors to efficiently manage their portfolios and engage in confident, well-informed trading.

Platform Categories

Trading platforms can be broadly categorized based on their primary function and target audience. Here are some common categories:

- Brokerage Platforms: These platforms are provided by brokers and allow investors to buy and sell a variety of assets, including stocks, bonds, ETFs, and mutual funds. They cater to a wide range of investors, from beginners to experienced traders.

- Day Trading Platforms: Designed for active traders who execute multiple trades within a single day, these platforms offer advanced charting tools, real-time data, and fast order execution capabilities.

- Automated Trading Platforms: These platforms allow traders to automate their trading strategies using algorithms and bots. They are popular among those who prefer a hands-off approach to trading.

- Mobile Trading Platforms: The Best Trading Platforms for Investors With the increasing popularity of smartphones, many platforms offer mobile apps that allow investors to trade on the go. These apps typically provide essential features like order placement, account monitoring, and real-time data.

Best Platforms by Investor Type

Different investors have varying needs and preferences when it comes to trading platforms. Here’s a breakdown of some of the best platforms based on investor type:

- Beginner: The Best Trading Platforms for Investors Look for platforms with user-friendly interfaces, educational resources, and low or no commission fees. Examples include Robinhood and Webull.

- Active Traders: These traders require platforms with advanced charting tools, real-time data, and fast order execution. Examples include TradeStation and Interactive Brokers.

- Long-Term Investors: The Best Trading Platforms for Investors Platforms with comprehensive research tools, diverse investment options, and low fees are ideal for long-term investors. Examples include Fidelity and Charles Schwab.

- Retirement Investors: These investors need platforms that offer retirement accounts (IRAs), low fees, and a variety of investment options, including mutual funds and bonds. Examples include Vanguard and TD Ameritrade.

Fee Structures and Costs

Understanding the fee structure of a trading platform is crucial for investors. Here are some common fees to be aware of:

- Commission Fees: These are charged for buying and selling securities like stocks and ETFs. Many platforms now offer commission-free trading, but some may still charge a fee per trade or per share.

- Account Fees: Some platforms may charge a monthly or annual fee for maintaining an account. These fees are more common with full-service brokers.

- Transaction Fees: The Best Trading Platforms for Investors Fees for specific transactions, such as wire transfers or transferring assets out of the account.

- Management Fees: For platforms that offer managed portfolios or robo-advisory services, there may be an annual management fee, usually a percentage of the assets under management.

- Other Fees: The Best Trading Platforms for Investors Additional fees may include inactivity fees, data fees for access to real-time market data, and fees for certain order types.

It’s essential to compare the fee structures of different platforms to determine the most cost-effective option for your investment needs.

Security and Support

The Best Trading Platforms for Investors Security and customer support are paramount when choosing a trading platform. Investors should ensure the platform employs robust security measures, including encryption, two-factor authentication, and regular security audits, to protect their funds and personal information. Reliable customer support is also essential, with multiple channels such as phone, email, and live chat, to assist with any issues or questions that may arise. Many platforms also offer educational resources, such as tutorials, webinars, and FAQs, to help investors navigate the platform and improve their trading knowledge.

Conclusion

Selecting the right trading platform is a critical decision. Investors should prioritize user-friendly interfaces, diverse order types, and real-time data. The Best Trading Platforms for Investors Understanding fee structures and comparing costs is essential for cost-effective trading. Robust security measures and reliable customer support are paramount. By evaluating key features, fees, security, and individual needs, investors can confidently choose a platform aligned with their financial goals.

Read More Articles : Bradley & Gigi’s Unexpected Spark

FAQs

Why is choosing the right trading platform important?

Choosing the right platform is crucial for investors as it directly impacts their ability to efficiently manage investments, execute trades, and achieve financial goals.

What are the key factors to consider when selecting a trading platform?

Key factors include user-friendly interface, diverse order types, real-time data, charting tools, fee structures, security measures, and customer support.

How important is a user-friendly interface?

A user-friendly interface is essential for both novice and experienced traders as it allows for easy navigation, quick trade execution, and a seamless trading experience.

What are diverse order types, and why are they important?

Diverse order types, such as market, limit, and stop-loss orders, provide flexibility in managing risk and executing various investment strategies.

Why is real-time data important for investors?

Real-time data is crucial for making informed decisions based on current market conditions and trends, enabling investors to react quickly to market changes.

Khush Rahe Sir

waooooo That’s Amazingly awesome

Aoa

amazing Sir

Youtube WatchtimemAthad Very amazing sir

Nice

That is very Helpfull Tips

Thanks For Help

That is Cool

Most Helpful