Venture Capital Advantages and Disadvantages: Is It the Right Choice for Your Business?

Introduction

In today’s fast-paced and competitive business landscape, securing the right funding can be the key to transforming a startup idea into a thriving enterprise. Venture capital (VC) has become a popular financing option for high-growth startups, especially in the tech, biotech, and innovation-driven sectors. Unlike traditional loans, venture capital offers substantial funding in exchange for equity, giving investors a stake in the company’s future success. While this can be a game-changer for entrepreneurs looking to scale quickly, it also comes with its own set of challenges and responsibilities.

Understanding the advantages and disadvantages of venture capital is essential before deciding if it’s the right path for your business. This guide will walk you through the key benefits and potential drawbacks of VC funding, helping you make an informed decision that aligns with your long-term goals. Whether you’re a startup founder or a small business owner, knowing what to expect is crucial.

What Is Venture Capital?

Venture capital is a type of private equity financing provided by investors to startups and small businesses with high growth potential. These investors, known as venture capitalists, provide capital in exchange for ownership equity or a stake in the company. VC funding is often sought by early-stage companies that lack access to traditional financing methods, such as bank loans. The goal of venture capital is not only to fuel growth but also to generate significant returns through eventual public offerings or company acquisitions.

How Venture Capital Works

The venture capital process typically begins with startups pitching their business ideas to venture capital firms. If a firm is interested, it will conduct due diligence—an in-depth review of the company’s financials, market potential, and management team. Once the investment is approved, funds are released in exchange for equity. Venture capitalists usually take an active role in guiding the business, often joining the board of directors and helping shape strategic decisions to increase the company’s value over time.

Types of Venture Capital

Venture capital funding comes in several stages, each designed to match the company’s development phase. Seed funding is the earliest stage, used to support initial product development or market research. Early-stage funding helps startups that have a minimum viable product and need capital to grow operations. Expansion or growth-stage funding is provided to more established businesses looking to scale significantly. Each stage carries different levels of risk and investor involvement, depending on the company’s maturity and potential for success.

Major Advantages of Venture Capital

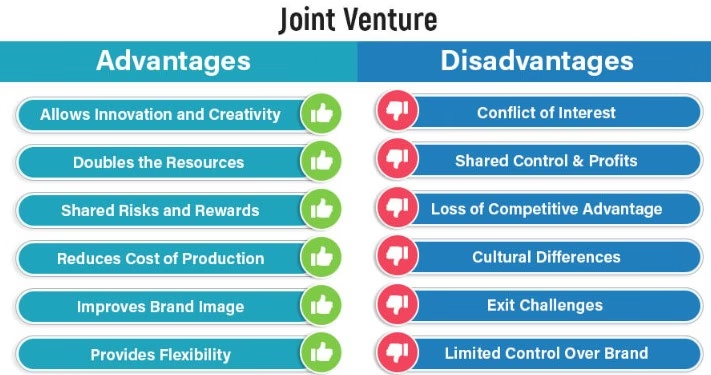

Venture capital offers several major benefits that can accelerate a startup’s growth. First and foremost, it provides substantial funding without requiring repayment, unlike loans. Startups also gain access to experienced investors who offer strategic guidance, mentorship, and industry contacts. This support can open doors to new markets, partnerships, and future funding rounds. Additionally, having a respected VC firm as a backer boosts credibility and can attract attention from customers, media, and potential acquirers. These advantages make VC funding attractive for ambitious entrepreneurs.

Strategic Guidance and Industry Expertise

One of the most valuable aspects of venture capital is the strategic support that comes with the investment. Venture capitalists are not just financiers—they often bring years of industry experience, business acumen, and a vast professional network. Many VC firms assign mentors or advisors who work closely with startup founders to refine business strategies, improve operations, and avoid common pitfalls. This guidance can prove crucial during the early and growth stages, especially for first-time entrepreneurs navigating the challenges of building a scalable and sustainable business.

Accelerated Business Growth

With access to significant financial resources, startups backed by venture capital can scale rapidly. This funding enables companies to hire skilled talent, invest in product development, expand into new markets, and strengthen marketing efforts. The speed of growth achievable through VC funding often outpaces what is possible with bootstrapping or small loans. This accelerated momentum can help businesses gain a competitive edge, capture market share quickly, and position themselves as industry leaders before competitors have a chance to catch up.

Major Disadvantages of Venture Capital

Despite its many benefits, venture capital is not without drawbacks. One of the biggest concerns is equity dilution—founders must give up a portion of ownership, which can lead to reduced control over the company. Venture capitalists may also influence key decisions or push for aggressive growth strategies that may not align with the founder’s vision. Additionally, the pressure to deliver rapid returns can be intense, sometimes resulting in burnout or risky business moves. These challenges make it important to weigh VC’s pros and cons carefully.

Risk of Misalignment with Investors

When accepting venture capital, startups enter into a partnership with their investors. While this relationship can be highly supportive, it also carries the risk of misalignment. Founders and VCs may have differing opinions on company goals, timelines, or exit strategies. For example, an investor might prioritize a quick exit through acquisition, while a founder envisions long-term independence. These differences can lead to friction, especially when investors have significant influence. Clear communication and shared expectations are essential to avoiding conflict and maintaining a healthy working relationship.

VC Funding vs. Other Financing Options

Venture capital is just one of many funding options available to startups. Others include bank loans, angel investors, crowdfunding, and bootstrapping. While VC offers large sums and strategic support, it also involves giving up equity and some control. In contrast, bank loans require repayment with interest but allow founders to retain full ownership. Angel investors may offer smaller investments with more flexible terms, and crowdfunding taps into public support without traditional investor influence. Comparing these options helps entrepreneurs choose what aligns best with their goals and risk tolerance.

Who Should Consider Venture Capital?

Venture capital is best suited for startups with high growth potential, scalable business models, and a clear path to profitability. Tech companies, biotech firms, and other innovation-driven startups often fit this profile. Businesses that require large upfront investments for research, development, or market expansion can also benefit. However, VC may not be ideal for founders who prioritize full control, slow and steady growth, or long-term independence. Understanding your company’s needs and future plans is essential before seeking this type of funding.

Key Questions to Ask Before Seeking Venture Capital

Before approaching venture capitalists, founders should evaluate their readiness and expectations. Ask yourself: Is my business scalable and ready for rapid growth? Am I comfortable sharing ownership and decision-making? Do I have a strong team and clear market opportunity? Can I handle the pressure to perform and deliver returns? Answering these questions honestly can help determine if venture capital is the right fit. Being prepared also increases the chances of attracting the right investors who align with your company’s vision.

Conclusion

Venture capital can be a powerful tool for fueling business growth, especially for startups with innovative ideas and high scalability. It offers more than just funding—it provides mentorship, strategic support, and access to influential networks. However, these benefits come with trade-offs, including equity dilution, shared control, and investor expectations. Choosing the right financing path depends on your business goals, risk tolerance, and long-term vision. By carefully weighing the advantages and disadvantages of venture capital, you can make a smart, informed decision that sets your business up for lasting success.

You Can Also Read: Trading 212 Uninvested Cash Interest

FAQS

What is an example of venture capital?

Example of venture capital

In 2011, Andreessen Horowitz invested $112 million in Airbnb, which was then valued at $1.3 billion. This investment helped Airbnb expand its operations and develop new products and services, which contributed to its rapid growth over the following years.

How does a VC make money?

VCs make money in two ways. Venture capitalists make money in two ways. The first is a management fee for managing the firm’s capital. The second is carried interest on the fund’s return on investment, generally referred to as the “carry.”

What pays more, VC or PE?

In general, you’ll earn significantly more across all three in private equity – though it also depends on the fund size. For example, in the U.S., first-year Associates in private equity might earn between $250K and $350K total. But VC firms might pay 30-50% less at that level (based on various compensation surveys).

What venture capital means?

Venture capital (VC) is a form of private equity and a type of financing for startup companies and small businesses with long-term growth potential. Venture capital generally comes from investors, investment banks, and financial institutions.

How to start a VC?

How to start a venture capital firm

- Step one: Know your track record. …

- Step two: Partner up. …

- Step three: Determine your VC firm’s structure. …

- Step four: Fundraise and form your fund. …

- Step five: Bring the resources back in. …

- Step six: Operationalize your fund.